Brands on Fire: TurboTax Marketing SVP on Courting Student Athletes During March Madness

TurboTax is perceived by most consumers as a do-it-yourself tax service, while its live full-service product, which enlists experts to assist users with doing their taxes, is less familiar to the public. Associating TurboTax with the latter is the brand’s primary marketing focus this year, and it’s amplifying that message through campaigns timed to tentpole events during tax season, including the Super Bowl and, most recently, the NCAA March Madness tournaments.

For new filers who are also student athletes—some of whom profited off of the NCAA’s updated “Name, Image and Likeness” policy—the brand has a new pitch. “This is the first full year that student athletes can make money off of their name, image and likeness,” Cathleen Ryan, SVP of Marketing at Intuit TurboTax, told Chief Marketer this week. “It’s a new reality for them. It just didn’t exist before.”

“Some of them are making a whole lot of money, and some of them are making a few hundred dollars here and there,” she added. “But either way, those NIL deals create tax implications. And it’s not just for the students. In many cases, the parents need to rethink their tax strategy as well.” Following is our conversation with Ryan about TurboTax’s March Madness campaign, how the brand is reaching Gen Z audiences on colleges campuses and through social media, new market opportunities, and more.

Chief Marketer: How is the messaging of the NCAA campaign different from previous years?

Cathleen Ryan, SVP of Marketing, Intuit TurboTax: We’ve been an advertiser in and around March Madness for years, but this is the first time we’re taking a collective approach to college athletes and students, inclusive of the NCAA partnership. But much beyond that, we’re going bigger with activating in new spaces, specifically where Gen Z and college students are natively, both physically and digitally.

Our entire program is rooted in education and empowering young adults who are just figuring out how to do life on their own, and providing them with the tools and resources they need to file their taxes with confidence, and know that they’re getting every possible dollar they deserve on their return. The NCAA sponsorship is a part of that, but we have college ambassador programs, a really big activation, and working with Influencer the platform that supports young student athletes.

CM: How are you incorporating the NCAA’s Name, Image, Likeness policy? That’s new for you, right?

CR: This is the first full year that student athletes can make money off of their name, image and likeness. Some of them are making a whole lot of money, and some of them are making a few hundred dollars here and there. But either way, those NIL deals create tax implications. And not just for the students, but for the parents. The big reason we’re so active in this space is that they need to be educated on what it means for their taxes and where to get help. And in many cases the parents need to rethink their tax strategy as well.

Student athletes are especially busy, given classes, practices and games. The last thing they want to talk or think about is doing their taxes. For us, it’s all about bringing help and resources directly to them, whether that’s on campus, working in partnership with the NCAA or with influencers. And then we have five or so individual university relationships where we’re reaching out through athletic departments, through student groups, et cetera, to ensure that the help and support is there. NIL is a new reality for student athletes. It just didn’t exist before. We want to make sure that they have the education and tools available to them so they’re not surprised at tax time.

CM: Beyond the messaging of this campaign, what are the strategic marketing goals?

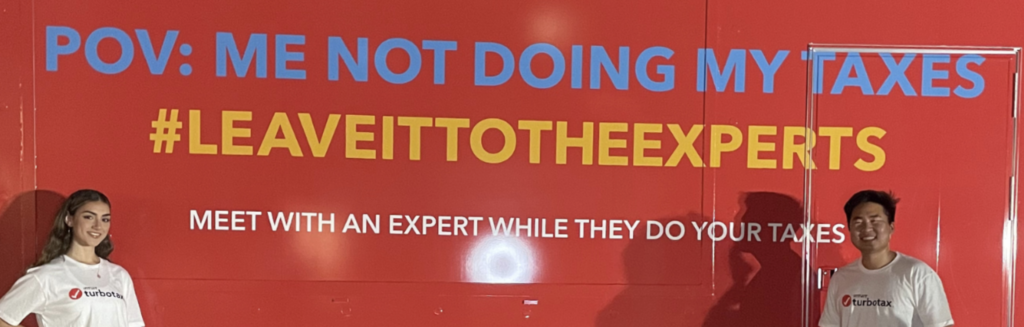

CR: We are looking to market full funnel through this effort, so everything from awareness, consideration, trial and purchase, ideally. We’ve experimented with a number of on-campus activations where students and student athletes can engage with our tax experts, ask questions and get expert answers. We’re providing a ton of content and resources for NIL athletes who need to do things like estimate their expenses, learn how to track expenses, things like that. It’s both awareness and consideration, but also engagement and education.

CM: Beyond this campaign, what are the other ways are you marketing to Gen Z?

CR: In addition to the NIL and influencer campaigns, we’re very active in the media channels and spaces with high Gen Z concentration. So, lots of TikTok, Twitter and social media in general. Media consumption has changed, so there’s streaming, OTT, Netflix. We were one of the first partners to sign on with Netflix ad-supported. We’re thinking about all the places and spaces where Gen Z spends their time, and where we can have a conversation, engage and hopefully entertain, too.

CM: In your research, have you noticed anything different about how younger consumers approach finance and taxes today?

CR: We have done some unique research around Gen Z—and they’re even less likely to want to talk about money and finances than previous generations. Unfortunately, it’s just a part of our culture. But where we can really make a difference is allowing people access to experts and tools, where they can find answers that they’re maybe not comfortable getting from friends or family.

One of the interesting things that we’ve seen with Gen Z in particular is a new way of working and living your life that is different than previous generations. You see a lot of side hustles or side jobs, and an entrepreneurial spirit. And that has tax implications. So it’s important for us, as TurboTax, to ensure that this generation understands the opportunities in and the implications of how they’re making a living, which does look materially different than previous generations.

CM: Where are you looking for growth and new markets this year?

CR: Ultimately, we want people to understand that TurboTax has a full suite of offerings. We have calcified brand perceptions of TurboTax as a DIY software product. But the reality is we are so much more than that. We have a growing full service business, where in a few easy clicks you can share your documents with a tax expert and they will prepare and file your return for you. We have an assisted product where you prepare your taxes with the help of an expert and it even includes a final review of your return, if you want that extra level of confidence before you hit the file button.

When you think about who that applies to, it applies to everyone. There is a huge opportunity, certainly for new-to-the-category filers such as student athletes, but also people that are overpaying a legacy tax pro who maybe doesn’t have the breadth of experience that TurboTax has. As an example, we prepare hundreds of thousands of returns with crypto expenses, gains and losses in them every year. Your local person down the street maybe has seen one of those. We’ve seen it all, and the expertise that comes with that ensures you get your best outcome. That’s the piece that we’re trying to get out in market this year: Come to TurboTax and don’t do your taxes. Let one of our experts do them for you. We are so much more than DIY and have been for years, but we need to get that message out there.