Mazza, Hy-Vee’s chief marketing officer and president of its retail media network, sits down with Multichannel Marketer to discuss how the grocer leverages its network of 10,000 in-store screens and the challenges of personalizing store marketing.

Kathryn Mazza joined grocery retail chain Hy-Vee to help build its retail media network, called RedMedia, in February 2024. Less than a year later, in January 2025, Hy-Vee named Mazza the chief marketing officer of the grocer, in addition to her role as president of RedMedia.

Mazza brings with her 18 years of experience from Dick’s Sporting Goods, where she honed her skills on enterprise marketing and launched the merchant’s retail media network.

The dual role — while a heavy load — ensures that Hy-Vee’s marketing department is not soiled, Mazza said. With Mazza overseeing both initiatives she can balance the content and how many marketing messages shoppers see from Hy-Vee, she said.

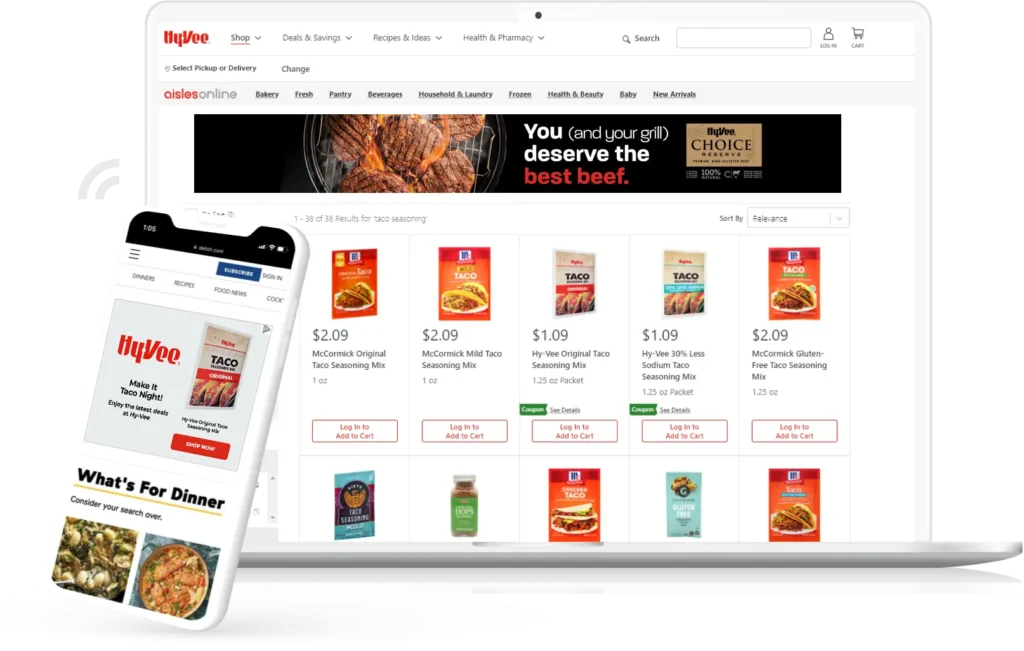

RedMedia debuted in September 2023 and has doubled its revenue since launch. It has about 130 advertisers on the network, Mazza said. Currently, digital is driving the most revenue for RedMedia, while in-store ads are growing at a faster rate, she said.

To power the in-store avenue of its retail media network, Hy-Vee has more than 10,000 digital screens across its fleet of 285 stores, such as when entering, at checkout, at pharmacy, in-aisle, and near the deli and meat counters. This can range from 25-30 screens in smaller stores and 100 screens in larger stores. Hy-Vee works with Grocery TV to stream ads on its screens, and it works with Vibenomics for in-store audio ads.

Mazza sat down with Multichannel Marketer to talk about the growth of its retail media network and other marketing initiatives to grow Hy-Vee.

Multichannel Marketer: Why is retail media is so hot right now?

Mazza: One, you’re reaching consumers directly when there’s very high purchase intent. Two, you’re giving advertisers access to first party data that they otherwise would not be able to have. And three, advertisers are seeing better returns. They’re seeing that they can get a better return on dollars invested in retail media networks than they could going and buying a year’s worth of TV.

MM: What types of in-store campaigns are your advertisers gravitating toward?

Mazza: I would say right now what we’re trying to do is actually build full packages where you include both (audio and screen advertising.) We’ve done some case studies where that’s seen the best performance. It is not just when you might do screens or just audio or just in-store graphics. It’s really the power of when you pair them all together and you have the screens within the audio message that they hear, and then enhanced graphics that they see. That’s where we’ve really seen the most success.

I would say right now the demand for the in-store screens is probably growing at a faster rate than audio. But again, in order to get the best ROI, we’re trying to package it all together and we’re really trying to build campaigns that follow the full consumer journey offsite on Hy-Vee.com and in store. And that’s where we’re really seeing the strongest return on investments come in.

MM: Is it surprising that digital drives the largest share of retail media ad spend for Hy-Vee, even though the large majority of Hy-Vee’s sales are in store?

Mazza: No, it’s not, because it’s like that with all of grocery. It’s because you can still tie in customers’ journeys online to their purchase in store. Some people prefer to go online put together their list online of what they want, and then they actually go in store and shop it. So it’s still very powerful for the brands to have all those ads online.

And then off-site, just general awareness on social media. If there is a new innovative product coming out, maybe it is a new flavor of a Coca-Cola product, and they want to get awareness out there of their product. Social media is a really powerful place to run media and let people know that there is this new product out there. Whether they end up buying it online or in store, I don’t think that necessarily matters, It’s about just getting the word out and the awareness of it.

MM: Do you guys have an average ROAS you share that your clients experience?

Mazza: For us, it depends on the goal of the campaign. We like to see ROAS at $3 and up, but they could range anywhere from $2 to we have $15 ROAS.

MM: How does that vary based on the channel?

Mazza: I would say the highest ROASes for bottom of the funnel are going to be for on-site media, our on-site banner ads, on-site sponsored product ads. And then you have your off-site media, off-site display ads or CTV, those will have typically a lower conversion rate. Social, with the walled gardens of Meta and whatnot, you can’t really get a good ROAS read on social too much.

Now in store, that is the area that we need to figure out how do we get that attribution and that measurement for in-store. We are in a beta test right now partnering with one of them across three of our stores.

MM: Is ROAS for in-store a KPI you offer to your advertisers right now?

Mazza: Right now we don’t, but we will.

MM: Is there a timeline goal?

Mazza: I would say in 2026 we want to be able to do it.

MM: Do you think shoppers want to see ads while they’re grocery shopping in store?

Mazza: If they’re relevant, yes. If they’re not relevant, I would say no, they don’t, and I don’t think that’s any different than online.

MM: How do you personalize ads in store when the demographics are everyone?

Mazza: Right now it’s really about zoning. So we have screens at the checkout stand. It is not helpful to a consumer to put on those screens at checkout a 30 pound bag of dog food ad that is in the very back of the store. What customer is going to get out of line, possibly make the people behind them annoyed, to go all the way back there to get the dog food; It’s just not going to happen. It’s not valuable and it’s not relevant to the consumer.

So what we do is do zoning in the store. So an ad that runs at the checkout area should be something that can be easily grabbed and easily purchased from that area. Then where you want to feature center store or products on the perimeter, you need to be able to feature those on screens that are generally in those areas. So whenever you’re keeping the product top of mind, it’s not so difficult for the consumer to then go locate the product and get it in their cart.

Now, I do think it’ll be interesting in the future to really personalize in-store experiences. Is there a way that you can use first party data or people using their app to say, ‘Hey, I’m going to follow their journey, and I know that Kathryn is logged into her app and she is now passing this digital screen and we’re going to put on their Neutrogena body wash because we know that she purchases that and she might be out of it.’ That is something really cool. Nobody can do that now, but that’s going to be the next big thing going forward is how do you personalize the shopper journey in store?

MM: Because right now it’s not personalized. The ad is just based on the location of the person in the store?

Mazza: They’re not personalized one to one.

MM: So how would you get to that level of personalization from the example you used about the shopper passing by a digital screen?

Mazza: As far as I’m aware of, there’s not technology out there that does it right now. I know that a lot of us leaders in the retail media industry and even tech companies talk about it. I just had one in here earlier today, and we were talking about how do you go from measuring in store to actually personalizing it? And how could you get to more of a one-to-one personalization in store?

What we’re seeing now is retailers are just now starting to understand that in-store is such a huge opportunity for retail media networks and to interact with the customer and engage with them. It’s going to be a slower burn and it’ll evolve, but it’s still new.

MM: How is RedMedia broadening its traditional audience profile?

Mazza: Retail media networks from a digital standpoint, they’re all going to be powered by using your first party data, and that is how you can feed the consumer’s relevant ads to wherever they consume media out in the marketplace or on Hy-Vee.com and then close the loop with reporting.

We have the ability through Hy-Vee ID to take our first party data and we put it through our identity graphing platform, Mercury. That is an identity platform Dentsu offers. So we will take our first party put into Mercury to go find other consumers that meet our profiles and then go run media off-site through The Trade Desk. So that’s a unique offering that’s out there that advertisers would not have access to those audiences through any other format than partnering with RedMedia.

MM: How much does that broaden the reach?

Mazza: It about doubles it.

MM: How many people do you have in your network?

Mazza: Millions.

MM: And that’s everyone who is in your loyalty program?

Mazza: Yes. It would be people that have the loyalty membership. What’s interesting about the Mercury platform is it actually does allow us to identify people that come to our site but are not logged into their loyalty account.

MM: Do you have an example of how the retail media team and the larger marketing team are working together and helping create a good journey for the shopper?

Mazza: One thing would be multi-brand campaigns, for example, a campaign that we did for Thanksgiving. We know as a brand for Hy-Vee, obviously Thanksgiving is a huge holiday for us.

What we did was the RedMedia team was able to go back and offer the suppliers to be a part of our Thanksgiving Day program. They had to be relevant. And so then we were able to offer that to the suppliers and bring revenue in from all of the suppliers and put it together to actually build a really large Thanksgiving campaign with all of the relevant products that you would need. We would target it to the relevant consumers.

So how that helped marketing is we were able to run a very efficient Thanksgiving campaign, and then have all of our key suppliers partner with us. The suppliers then they only paid for one 10th of a campaign, but they got the reach and frequency of a campaign that had the value of 10 times what they actually had to invest.

So multi-brand campaigns is something we offer. And that’s something we’re doing for key relevant moments. Grilling, for example, there’s going to be a lot of different brands that would want to participate in a grilling campaign. So how do we have them all just invest a little bit in an actually really large meaningful campaign. And they’re going to see really strong returns from their smaller investment.

MM: What was the average return in the Thanksgiving campaign?

Mazza: For each brand, it was over $8.

MM: And how does that benefit Hy-Vee?

Mazza: We have a Thanksgiving campaign out there that we’re reaching our consumers where they want to consume media with all relevant products from some of the top brands that have products that make for a wonderful Thanksgiving dinner. And RedMedia powered that campaign. So it wasn’t a campaign that Hy-Vee was paying for out of our marketing budget. It was kind of a funded campaign through the power of all of our suppliers.

MM: As a CMO, what’s on your radar for the rest of this year?

Mazza: Oh, there’s a lot of things on my radar. Measurement of all of our marketing is something that’s going to be a huge focus of mine, and AI is certainly on my radar. We hear a lot of companies and tech platforms talking about AI, an it’s something that I’m going to really be digging into to understand what are the business cases where retailers are using AI, what are the success stories and how is it truly adding value to the customers and to the retailers? So that’s going to be a big focus of mine.

This interview has been edited for length and clarity.