Change begets change. And in response to the continuing changes and uncertainty regarding tariffs, marketers are amending their strategies and tactics, focusing more on highlighting value and cutting spend on non-digital channels.

Of the 220 clients surveyed by SMS and email marketing platform Attentive in May, 86% were adjusting their messaging to emphasize value. Roughly 55% were spotlighting product quality and durability, making this the most popular approach overall.

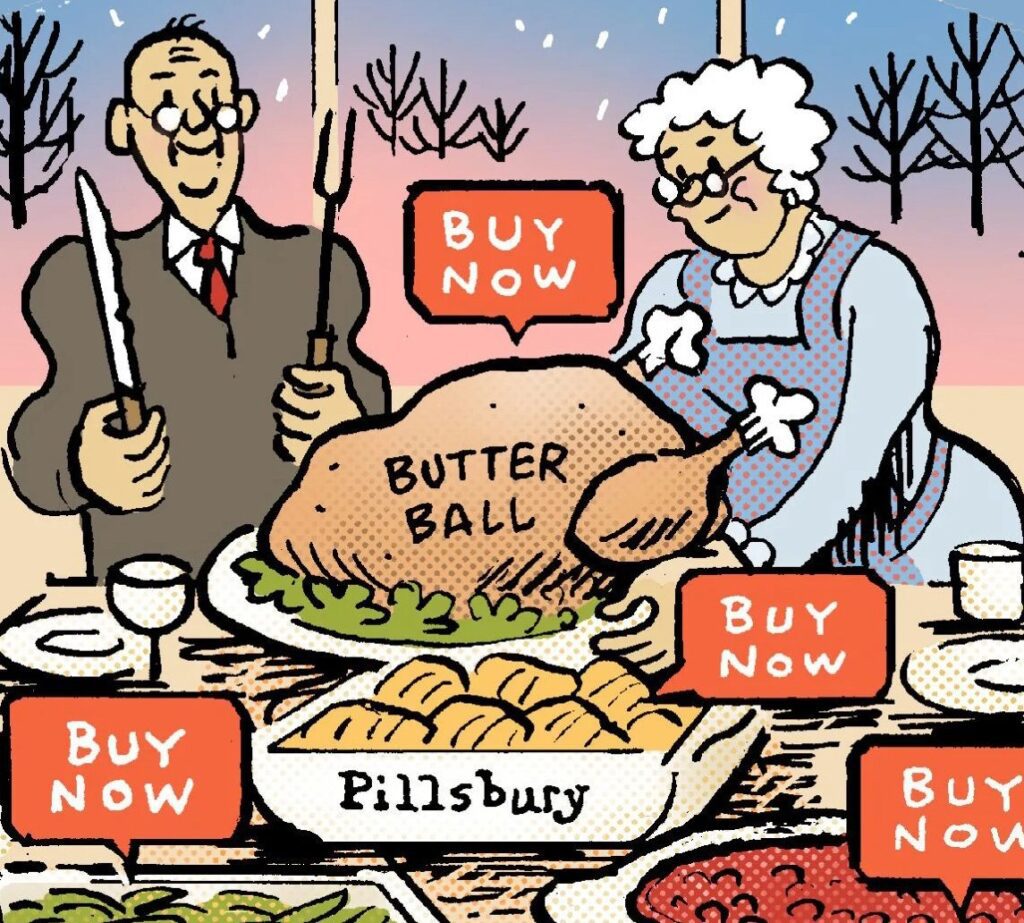

Among apparel marketers and home and office brands, however, focusing on unique design elements or exclusivity was the top tactic, while the number-one approach for food and beverage brands was to highlight the brand heritage or story. Overall, 40% of respondents were adopting either of those approaches. About a third of marketers were emphasizing product performance benefits, and more than 20% were touting sustainability and ethical production.

Increased Transparency

Sixty-nine percent of marketers plan to be more transparent when communicating price changes. Although 50% have no formal plan in place, 29% are proactively announcing changes and providing context around them. Just 11% are explaining price increases only when customers ask.

Taking a reactive approach to price changes could weaken brands’ relationships with customers, if Attentive’s April survey of 600 consumers is any indication. In that earlier study, 61% of consumers wanted to know when prices would change and by how much; only 6.5% didn’t want pricing communications at all.

Leading Communication Channels: Email and SMS

Of those marketers opting for transparency regarding pricing changes, half are using SMS, email and other direct communication channels to reach consumers. More than a third (36%) are training their customer service reps on how best to respond to customer queries. Less than 20% intend to add price-related website banners or social media announcements.

Email and SMS are the two channels where marketers are most likely to increase their spend and least likely to cut back. Less 10% plan to cut their SMS budgets, and nearly 20% will spend more on the channel. About a fifth of those surveyed intend to boost their email budgets, while just 2% plan to cut their email spend.

These budget shifts correlate to the perceived effectiveness of the channels in uncertain times. Email was deemed a top revenue driver by 78%, making it the most effective channel in the eyes of the respondents. Food and beverage marketers were even more enthusiastic about it: 93% listed it as a top revenue driver, as did 89% of fitness and wellness brands. SMS ranked in second place, followed by paid search and paid social.

In contrast, fewer than 10% of respondents credited nondigital media such as OOH and TV, retail media and direct mail as top revenue producers in times of uncertainty. So it’s no surprise that marketers are most likely to be reducing spend on these channels. Approximately 30% will be reducing their retail media spend, for instance, with some 40% cutting their direct mail budgets and slightly more decreasing spend on non-digital channels.

Inventory Contingencies

Beyond possible price hikes, the tariff tumult is also causing inventory concerns. Looking ahead to the next three to six months, 64% of marketers either anticipate inventory shortage or aren’t sure what to expect.

Marketers are putting contingency plans in place should they suffer shortages. For 51%, that means shifting their promotional focus to in-stock merchandise; 41% will accept pre-orders and enable customers to sign up for back-in-stock notifications. If they’re not already doing so, a third intend to promote similar or complementary skus when top items are low in stock, and roughly 15% will bundle low-inventory skus with well-stocked ones to avoid taking a hit in average order values.

Black Friday/Cyber Monday promotions are also subject to flux, with 94% of marketers open to changing their strategies in the face of inventory challenges. For 7%, those strategic shifts will affect the timing of their Black Friday/Cyber Monday promos.

If possible, brands might want to consider offering promos sooner rather than later. Of the 600 consumers Attentive surveyed in May , 27%—including 45% of Gen Z—intend to start holiday shopping earlier than in years past.