Mike Nevin, a county supervisor in San Mateo County, CA, spearheaded a movement to get his county to pass a local ordinance forcing banks to get customers’ permission before sharing or selling personal financial information.

And California state senator Jackie Speier plans to reintroduce a bill this legislative session that would allow consumers the option of not allowing banks to share their financial information with third parties.

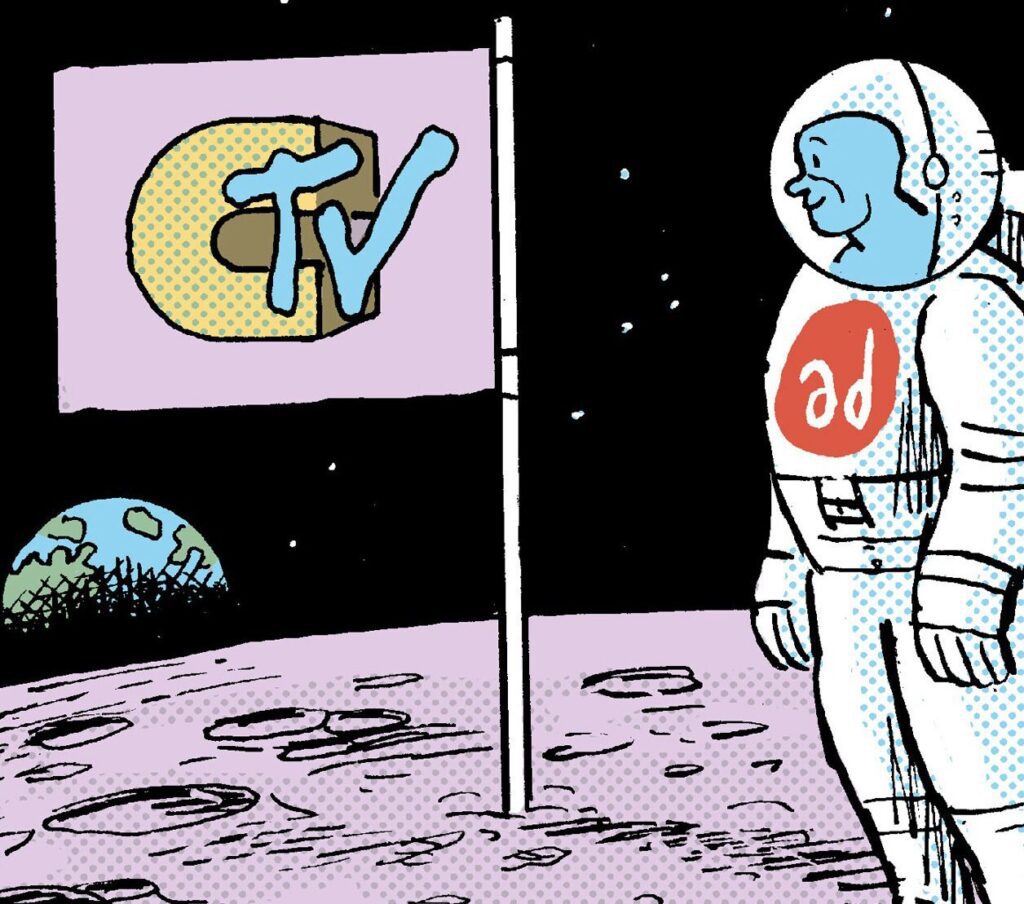

CBS Television’s 60 Minutes reported on the two initiatives earlier this week.

“What the two California legislators didn’t address were the costs to consumers of their essentially opt-in models,” said Direct Marketing Association spokesman Lou Mastria.

He said DMA studies in 2002 showed that costs of home mortgages would go up by as much as $2,000 under such a system and personal credit card costs would go up by several million dollars a year.

“I think that the legislators were not being forthright about the costs of such a program,” Mastria said.

According to 60 Minutes, Nevin was outraged to find out how much information banks can legally pass along to third parties once they have done business with consumers, making billions in the process.

Two banks doing business in San Mateo County — Wells Fargo and Bank of America — have sued the county and Nevin, temporarily blocking his ordinance.

Nevin countered by urging every county in California to follow his lead. Several, including San Francisco County, Alameda County, Contra Costa County, Solano County and Santa Cruz County, did just that.

The ordinances passed by those counties would be nullified if Speier’s privacy bill becomes law this time. Nevin thinks of his local ordinance as a start, a way of regaining at least a little of the power that information has over our lives and over our phones.

60 Minutes highlighted Speier

Network

Network